Financial capital is a common opportinity for a residential property people in order to and obtain funding functions. Individuals whom derive local rental earnings regarding money attributes have many crucial tax holiday breaks available to her or him.

This information discusses probably the most well-known local rental assets taxation write-offs, including depreciation, financial focus, capital improvements, and you may family equity financing interest.

Local rental Possessions Tax Deductions

Landlords can also be disregard of many expenses associated with having and you may maintaining a rental property because Internal revenue service snacks property possession like any other businessmon https://paydayloanalabama.com/double-springs/ providers write-offs were marketing industry costs, record fees, provides, tools, home business office, and you will travel expenditures linked to possessions possession.

Here are four most income tax deductions myself linked with disregard the possessions that will somewhat slow down the matter you are able to are obligated to pay into Internal revenue service every year:

Depreciation: From year to year, landlords is depreciate 1/39th of one’s expenses associated with obtaining and keeping commercial qualities, while you are domestic landlords is deduct step one/twenty-seven.5th. These deductions are seen as the typical wear-off of the real property property. However, once you offer new house you’re going to have to shell out that it money into the type of a decline recapture tax.

Assets taxation: The bucks paid down to condition governing bodies for assets fees was allowable towards Schedule Elizabeth of one’s annual income tax get back. This type of deductions additionally include one relevant unique easement, residential property, otherwise college or university district fees.

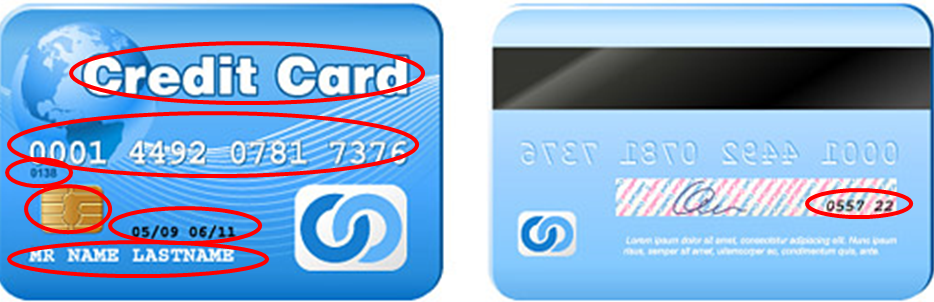

Mortgage interest: The firm you to holds the mortgage of your funded assets often distribute a form 1098 at the beginning of the entire year. This type suggests just how much you have paid in financial interest, that is totally tax-deductible.

HELOC attention: Home owners usually takes out a house security personal line of credit to pay for high improvements on the local rental properties. These investment expenses cover anything from a separate roof, Hvac system, otherwise repaving a parking lot having a multiplex. The eye repayments on the domestic security financing and you will family collateral contours regarding borrowing are tax deductible.

The conclusion

With regards to the Internal revenue service, you could deduct domestic collateral loan notice on your investment possessions offered you can have shown your made use of the fund adjust otherwise renovate the house or property.

If you are planning to obtain a house guarantee loan so you’re able to upgrade a home or grasp toilet, or even to set-up a bonus area and other highest money update endeavor on your own local rental assets, be sure to remain detail by detail facts of all of the expenses and you may really works repaid with home collateral financing finance you have the documents in order to satisfy one Irs review requirements.

That it procedure is for standard information and you will informative aim simply. Information is based on study gained about what we feel try credible source. That isn’t guaranteed as to reliability, cannot purport become complete which will be perhaps not designed to be used just like the an initial reason for money behavior. It should as well as not be construed given that pointers conference the specific funding requires of any investor. Knew cannot offer tax otherwise legal counsel. This material is not an alternative to seeking the pointers out-of a qualified professional to suit your personal situation.

Tax-Deferred Strategies Using IPWM

By providing their email address and you can contact number, youre opting to get interaction out of Knew. For many who discovered a text message and pick to get rid of finding after that texts, react Avoid to help you instantaneously unsubscribe. Msg & Analysis cost can get apply. To manage finding characters from Understood look at the Perform Choices hook up in every email address received.

Realized

- eight hundred W. 15th Street Collection 700 Austin, Colorado 78701

- (877) 797-1031

Contact us

Realized1031 are an online site manage from the Know Development, LLC, an entirely owned subsidiary away from Realized Holdings, Inc. (Realized). Security securities offered on this site are provided exclusively as a result of Knew Monetary, Inc., an authorized agent/agent and member of FINRA/SIPC (“Realized Monetary”). Resource advisory functions are provided due to Understood Financial, Inc. a subscribed resource agent. Know Financial, Inc. try a part from Realized. Check the records of this enterprise towards FINRA’s BrokerCheck.

Hypothetical example(s) was for illustrative aim just and therefore are maybe not meant to show for the past or future show of every specific financial support.

Committing to alternative property concerns highest risks than conventional investments and you may is appropriate just for advanced level buyers. Solution investments are often offered by the prospectus you to shows every dangers, charges, and you may expenditures. They are not income tax efficient and you may an investor is speak with his/the girl taxation mentor ahead of investing. Choice opportunities features higher fees than simply old-fashioned investment in addition they will get additionally be highly leveraged and you can do speculative money process, that can magnify the opportunity of investment loss otherwise gain and you will really should not be deemed an entire financial support system. The value of the fresh financial support will get slip and increase and dealers gets back less than they spent.

The website was blogged getting people of United states exactly who is actually certified traders simply. Joined Representatives and Investment Mentor Representatives might only do business which have people of one’s states and you may jurisdictions in which they are properly joined. Thus, a response to an ask for suggestions are defer up to compatible subscription was received otherwise exclusion out of registration is set. Not every one of qualities referenced on this web site are available in the state and through most of the affiliate noted. To find out more, delight contact 877-797-1031 or